Navigating the world of Medicare can be overwhelming, especially when you encounter an array of unfamiliar terms and jargon. In this blog, we aim to simplify the complexity by providing a thorough glossary of terms and definitions related to Medicare. Whether you’re new to Medicare or simply looking to enhance your understanding, this resource will help you make better decisions and confidently navigate the different Medicare types, including Parts A, B, C, and D, as well as the Medigap plan. Get ready to unlock the critical terminology to comprehend better and optimize your Medicare coverage.

Original Medicare

What does it do?

This is the only way to enter Medicare insurance plans. The world of Medicare starts here. Medicare is a federal health insurance program in the United States. Original Medicare has two parts: A and B.

Part A covers hospital insurance, such as stays, nursing facility care, hospice care, and home care. Part B of Original Medicare covers doctor’s visits, outpatient care, home health care, medical equipment, and screenings.

How to obtain Parts A and B?

One is eligible for Medicare if they are 65 or nearing 65. Note that Medicare health care services are designed to provide insurance to seniors. However, people under age 65 can still qualify for Medicare if they have end-stage renal disease and amyotrophic lateral sclerosis.

Medicare Advantage Plan

Aka: Medicare Part C

What does it do?

Although Parts A and B offer substantial health insurance to their members, more is needed. Medicare holders may need more benefits than what Original Medicare offers. So, this is where Part C comes in.

With Part C (supplemental coverage of Original Medicare), members can now enjoy additional Medicare benefits such as dental, vision, hearing, and even prescription drugs (which can be obtained by Medicare Part D). With Part C, Medicare members can now have comprehensive medical insurance, ensuring peace of mind.

How to obtain Part C?

One must first enroll in Original Medicare (Part A and Part B) to use Medicare Part C. After enrolling in Original Medicare, individuals can enroll in a Medicare-approved private insurance company that offers Part C plans.

Medicare approves these private insurance companies to provide coverage and benefits beyond what Original Medicare offers. Researching different plans and choosing one that best suits individual healthcare needs and preferences is essential.

Medicare Prescription Drug Coverage

Aka: Medicare Part D

What Does It Do?

Medicare Part D is prescription drug insurance coverage for individuals taking medically necessary drugs for their healthcare maintenance. Enrolling in Part D can lower the prices of outpatient prescription drugs.

Private health insurance companies provide this coverage, which helps reduce the cost burden of necessary medications, making them more accessible and affordable for beneficiaries. Reviewing and comparing different Part D plans to find one that covers the required medicines at the most cost-effective rates is essential.

How to obtain Part D?

It is important to note that Medicare Part D can be accessed through private insurance plans. To enroll in Part D, an individual must first have Original Medicare. There are two ways to enroll in Part D, either through a Part C plan or independently, which means enrolling in Part D along with Original Medicare without the extended benefits provided by Part C.

It would help if you compared different Part D plans to find the most suitable coverage for your needs and health requirements.

Medicare Supplement Plan

Aka: Medigap

What Does It Do?

Medigap, also known as Medicare Supplement Insurance, fills in the gaps in coverage left by Medicare. It helps pay for out-of-pocket expenses, including deductibles, copayments, and coinsurance, which can add up quickly for Medicare beneficiaries.

With Medigap, individuals can have peace of mind with lower personal health care spending, knowing that unexpected healthcare costs won’t burden them. Private insurance companies offer these supplementary plans, varying coverage options and costs. Finding the right Medigap plan ensures comprehensive and affordable healthcare coverage for Medicare members.

How to Obtain Medigap?

During the Initial Enrollment Period (IEP), you can quickly obtain Medigap coverage with Original Medicare. However, if you choose to enroll outside of this period, you may be subject to eligibility requirements such as medical underwriting set by private insurance companies.

It is important to remember that enrolling during IEP ensures guaranteed rights to Medigap without any medical underwriting or pre-existing condition exclusions.

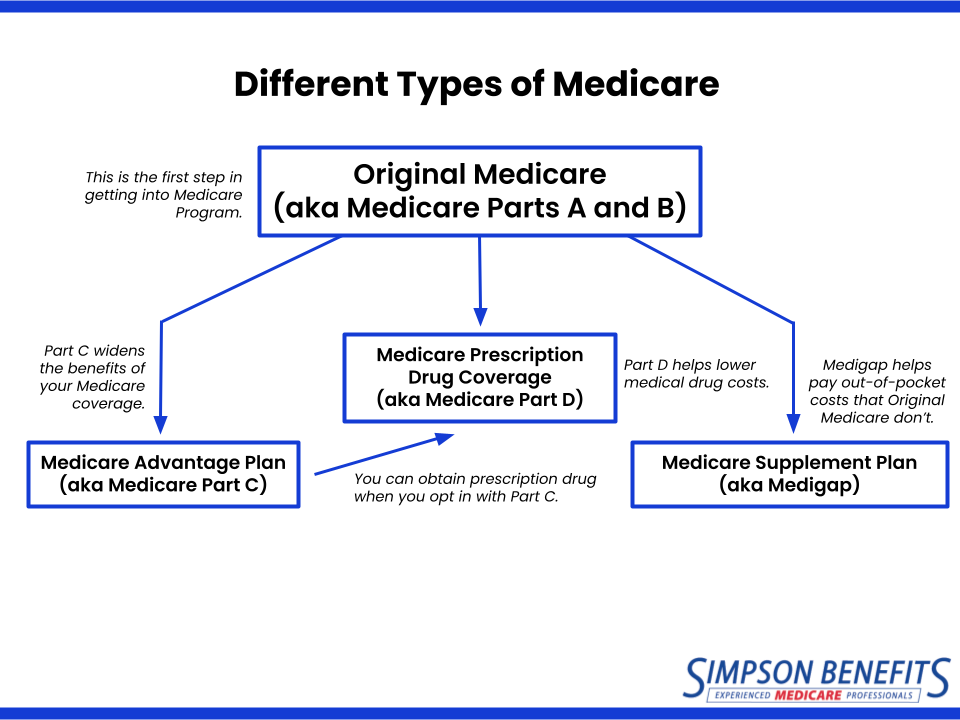

Below is an illustrative diagram of the overview of Medicare types, making it easier to understand their interrelation: