What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap policies, cover out-of-pocket costs that Original Medicare doesn’t pay for. These plans are designed to cover healthcare costs. Medicare does not cover certain expenses, such as deductibles, copayments, and coinsurance. Medicare Supplement Plans are represented with letters (A, B, C, D, F, G, K, L, M, and N). Each offers a different level of coverage. Beneficiaries can choose a plan based on their specific needs and budget. These plans provide peace of mind by reducing out-of-pocket expenses and ensuring comprehensive coverage for Medicare beneficiaries.

The information below will let you know the Medigap basics and what you need to know about the plan.

Medigap Plans

Ten standardized Medigap coverage plans are available, each labeled with a letter from A to N. There are variations in the benefits and coverage offered by these plans. Plan A is the most basic, covering essential benefits such as Part A coinsurance and hospital costs. Plans B, C, D, F, G, M, and N offer increasingly comprehensive coverage, with Plan F being the most comprehensive (which was discontinued and replaced by Plan G). Plans K and L have lower premiums but higher out-of-pocket costs. Plan M provides moderate coverage, while Plan N has copayments and coinsurance requirements. It’s essential to review the details and costs of each plan to choose the one that best meets your healthcare needs.

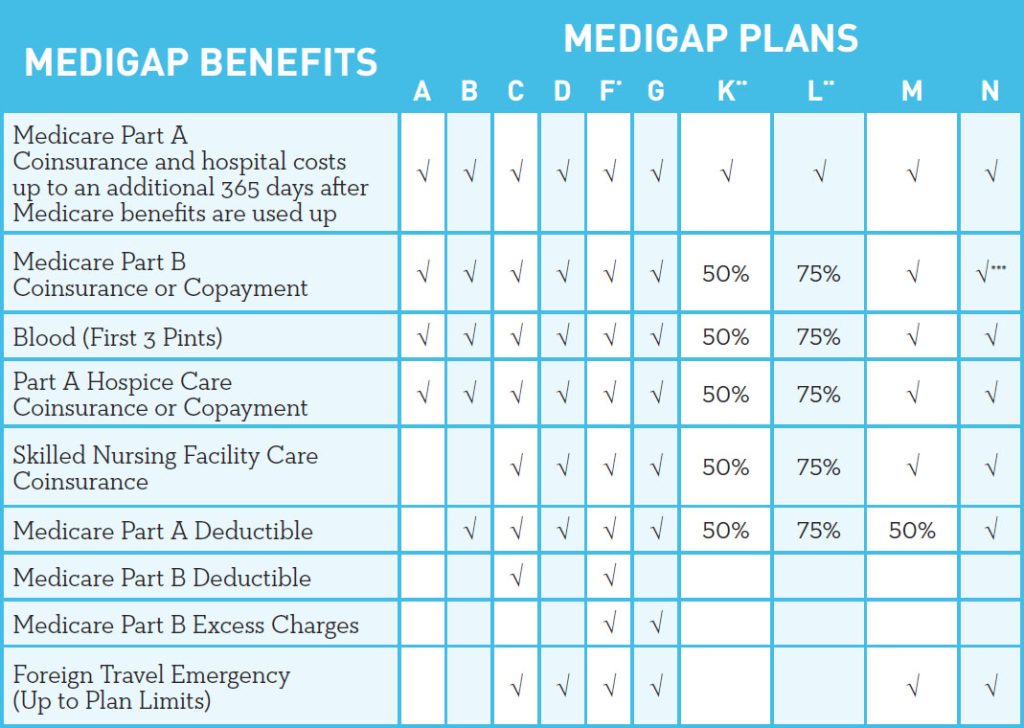

The chart below from the Pennsylvania Insurance Department shows a comprehensive comparison between different plans:

Benefits

Medigap insurance is standard across all insurance companies. This means that Plan A, for example, will offer the same benefits regardless of your chosen company. However, the premiums charged by each company may vary. It is crucial to compare prices from different insurers to get the best value for your money. Additionally, it’s essential to understand that Medigap plans usually do not include dental or vision coverage. Therefore, if you require these services, consider separate insurance plans or explore alternative options to meet your healthcare needs.

Requirements

To be eligible to join a Medigap, you must already be enrolled in Medicare Part A and B. You cannot have any other health insurance coverage, such as Medicaid or employer-sponsored group coverage. It is important to note that private insurance companies sell Medigap plans, and they can set certain eligibility criteria, such as age restrictions or medical underwriting. However, during the Initial Enrollment Period, individuals have guaranteed issue rights, allowing them to enroll in a Medigap plan without being subject to medical underwriting.

Are you Looking for a Medigap Policy? And from Pennsylvania?

If you are a Pennsylvania resident and need a Medigap policy, look no further than Simpson Benefits. You’re assured that you will receive the best options and personalized advice to choose the right plan for your needs. Regarding Medigap Pennsylvania, you’re sure you’ll get the best price with the most suitable plan.

Whether you plan to have a Medicare Supplement plan or any plans, like Medigap and Medicare Advantage, Simpson Benefits has you covered. Don’t wait any longer – secure your Medigap policy today and enjoy peace of mind knowing you have the coverage you deserve.